A few years ago at Christmas time, money was tight.

My house was continuing to be its spectacularly needy self, I'd just bought a new-to-me car (and snow tires for that new car and a new alternator for the old car which wasn't yet sold) and it was, well, Christmas.

Christmas was to be a family affair, that year at a rented house near Barrie, Ontario. My mother, retired, left early so she could gobble up as much adorable time with her grand-baby as possible.

|

| "My, what pretty teeth you have, grandmother." |

My dad and I, employed, left Christmas Eve for the long southerly drive. We took my new car, its virgin cross-provincial trip.

|

| Because it was my car, we barely even listened to talk radio. |

We made it to the gas station in Napanee where I filled the car. Oddly, the machine wouldn't allow me to pay outside; thinking nothing of it, I went inside.

I'm pretty sure that a dictionary definition of awkwardness is standing in a gas station two and a half hours from home on the phone with your credit card company asking why they will not let you pay for the $20 of gasoline that you just finished putting in your car.

The reason? My card was compromised. The credit card company was going to mail a new credit card to my house, scheduled to arrive in the second week of January when their office wasn't on holiday anymore. None of this was useful to the person who was headed away from her house and who would have great need of the card over that period of time to do holiday things, like skiing and filling my car with gas.

They gave me one glimmer of hope: I could use the card if I used the chip feature and typed in the pass code.

At the time, the chip feature was brand new to Canada. Only the newest machines accepted them. The odds were not in my favour.

We finally made it to the destination and, worries pushed aside but not forgotten, I Christmased the snot out of Christmas.

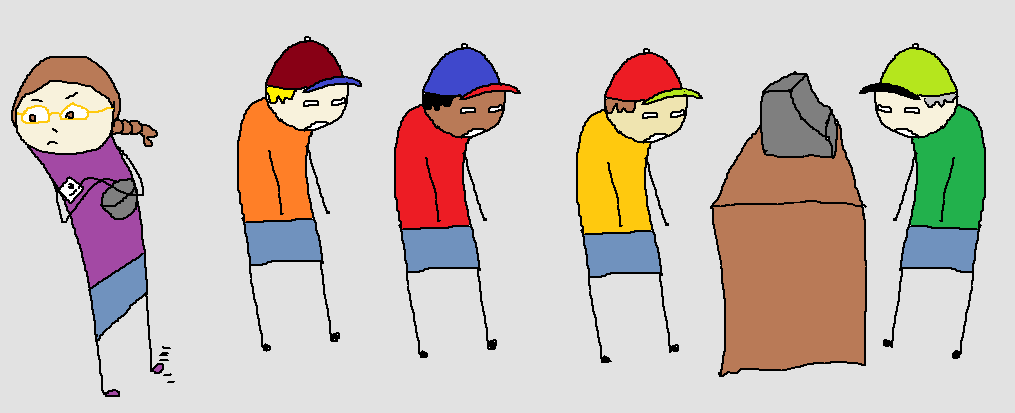

Unfortunately for me, the city that we stayed in was small and did not have the most up-to-date technology.

|

| "We've got the thingie, but it's not activated yet." |

|

| "What in the heck is that chip for?" |

|

| "Oh no, we don't take credit." |

I still paid for things, but these things were paid for with my Interac card, the money drawing directly from my bank account.

This was a problem. Because of all the circumstances surrounding that particular moment in time, I was scraping the bottom of the financial barrel. My plan for paying off my credit card included not only the money that I had in my bank account, but also the money that I would earn from my pay cheque.

I should note that this plan was not a good plan. It was a terrible, no-good plan that I would recommend to no one (though it was slightly better than not paying my credit card bill at all). The horrible plan hinged on my continued access to that credit card. Without it, my finances started to look more like this:

When faced with what seemed at the time like insurmountable odds, I did what any reasonable person might do; I appealed to a higher power.

|

| "Hello, customer service. ...hello?" |

After hearing my tale of woe, the company agreed that I could defer my payment of my credit card bill. To keep my credit rating intact, they advised me to pay the absurdly low minimum payment. They promised me that I would be charged no interest.

If this were an epic story, then there would be a twist at this point. They didn't just agree to do something and then actually DO it, did they?

|

| Which segues into the story of how I turned to drug running to pay off my credit card debt... allegedly. |

I was lucky; it rolled out exactly as they promised.

|

| I'm sorry. It's just how I am. |

From this experience, I was able to learn for free an important lesson about credit cards: don't charge more than you have in the bank.

There are much more expensive ways to learn this lesson. Please note that I don't advise any of them.

No comments:

Post a Comment